Sanofi myFlex is a flexible benefits program for all salaried employees across Canada. This microsite provides you with information about how Sanofi myFlex works, what flex credits are, how to use them, and how to enroll and make changes in the program. Take some time to explore this microsite to learn more about Sanofi myFlex, your myFlex options, and how to select the options that will best meet your needs and the needs of your family for each enrollment cycle.

Sanofi myFlex provides you with an expansive and versatile benefits program that enables you to personalize your benefits package to best meet the unique needs of you and your family. Sanofi myFlex provides you with choices, flexibility, and a helpful Benefits Centre to enhance your benefits experience.

But why offer a flexible benefits program? In short, because we’re all different. We are very diverse and in different stages of our lives. We have different family situations, health needs, and unique benefits coverage requirements. A traditional, “one-size-fits-all” benefits program does not provide the flexibility we need.

A flexible benefits program like Sanofi myFlex puts the control in your hands. It allows you to decide how Sanofi’s benefits dollars are spent for you and your family, and it allows you to personalize your benefits program to fit you and your family’s unique and changing needs.

The Sanofi myFlex program is a comprehensive and flexible suite of benefits that gives you a wealth of customizable options, a competitive and consistent benefits experience, and improved service from our providers. Most important, Sanofi myFlex enables you to build your own benefits package that meets you and your family’s unique coverage needs.

Sanofi myFlex includes the extended health care, dental, life, accident, and disability coverage you would expect. It also includes some features that deliver extra value to you and your family:

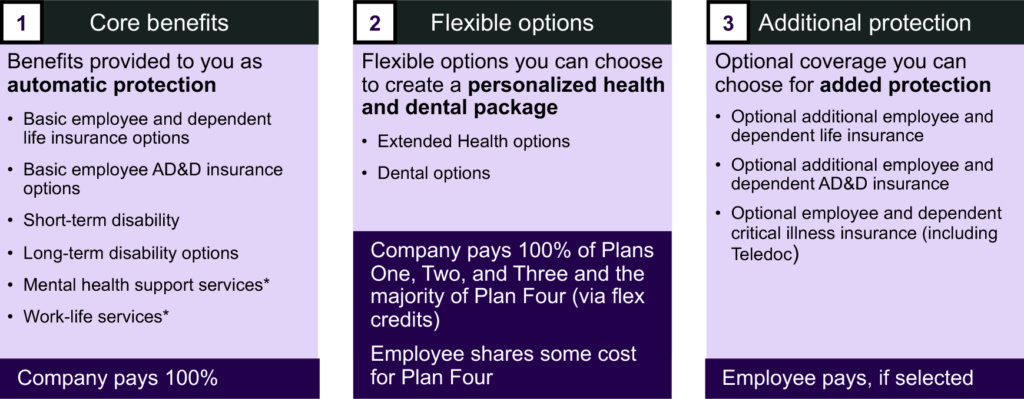

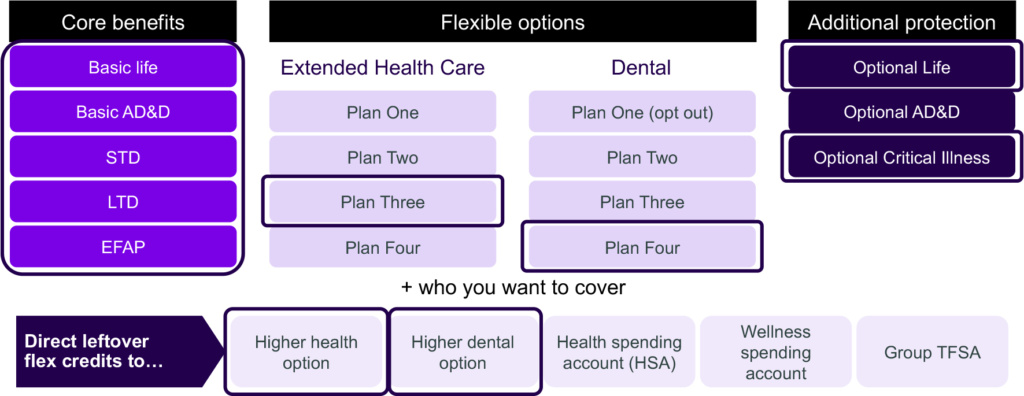

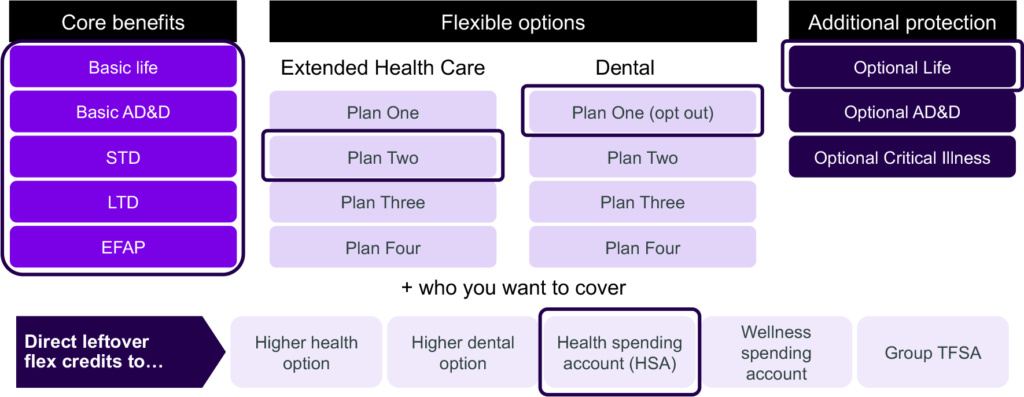

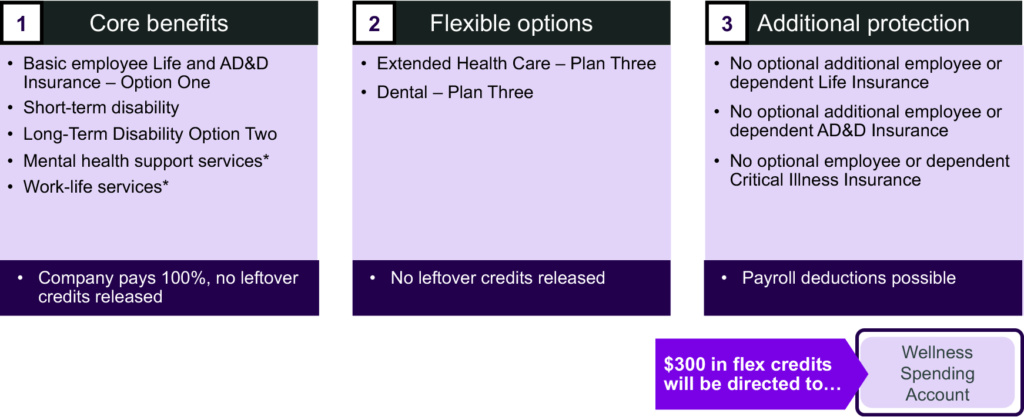

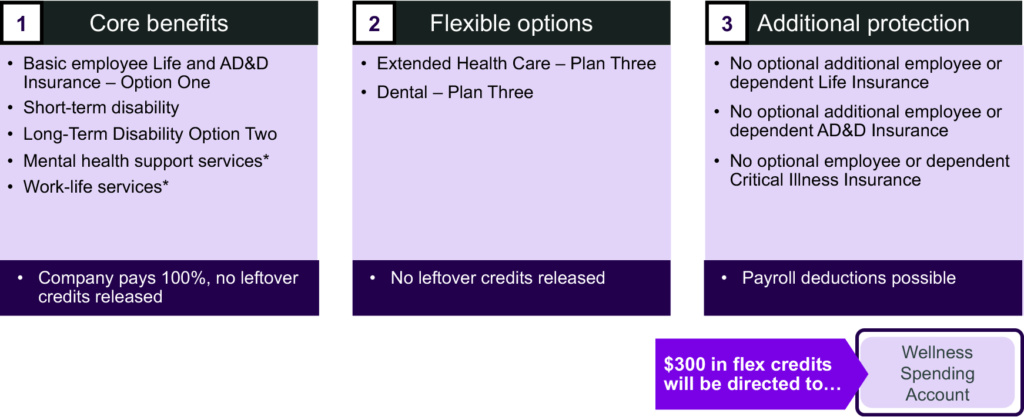

More specifically, Sanofi myFlex provides three types of coverage, with flexible options in each category that you can tailor to you and your family’s needs:

* Sanofi provides a variety of mental health support and work-life services for you and your family. For more information, please visit All Well Canada.

Benefits are personal. And it’s rare for any two employees to select exactly the same benefits package. For example, one employee might choose to reduce some of the basic core benefits provided by Sanofi and use the credits released through their lower choices to help pay for their family’s higher Extended Health Care and Dental coverage needs. Alternatively, a colleague might opt to take the full core benefits options but with lower Extended Health Care and Dental Plans so they can put their leftover credits into their Health Spending Account (HSA) to cover a wider range of expenses (see Options for leftover flex credits below).

That’s what’s great about Sanofi myFlex – it allows you to tailor your benefit options to meet the unique needs of you and your family.

It’s important that you invest time in learning and updating your knowledge about the Sanofi myFlex program, examine your options, and decide which combination of coverage will be right for you and your family so you are ready to make or update your selections during open enrollment at the beginning of June every other year.

Please review the details and your options within each plan in the Your Sanofi myFlex options section below and the information in Which Sanofi myFlex options are right for you? to help you make or update your selections.

An important feature of Sanofi myFlex is the availability of flex credits. Each year, you will receive flex credits from Sanofi to help you personalize your benefits. Flex credits work like money that you that you can use to “purchase” your flexible options, and they are loaded into the online enrollment tool before the start of benefits open enrollment.

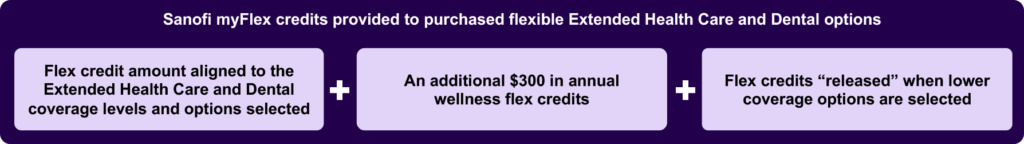

The flex credits you will receive fall into three categories:

Your flex credits are first used to pay the premiums for your Extended Health Care and Dental options. Based on your selections, you may have flex credits leftover. You are able to choose how to use these excess credits in the enrollment tool. Your leftover flex credits can be used to fund one or more of the following:

If the cost of your benefits selections exceeds your available flex credits, you will cover the difference through bi-weekly payroll deductions.

For more details on your annual flex credit amounts and how benefit costs are shared between Sanofi and employees, please see Cost of Extended Health Care and Dental Plan options within the Extended Health Care Plans and Dental Plans sections below.

Based on your choices for your core benefits and flexible Extended Health Care and Dental Plans, you may have flex credits leftover. You will be able to choose how to use them in the online enrollment tool. You can choose to direct your leftover flex credits to one or more of the following:

This section describes each of your options for leftover credits and the advantages of each.

If you choose, you can use any leftover flex credits you may have to offset the cost of higher Extended Health Care coverage available in Plan Four. This will help reduce your bi-weekly payroll deductions.

Similar to using your leftover credits to offset any payroll deductions you may have for your Extended Health Care coverage, you can also choose to use any leftover flex credits you may have to offset the cost of higher Dental coverage. This will also help you reduce your bi-weekly payroll deductions.

During each open enrollment period, you can allocate some or all of your leftover flex credits to your Health Spending Account (HSA). You can use the HSA to pay for Extended Health Care and Dental expenses for you and your eligible dependents – including those who are not covered, or not fully covered, by Sanofi myFlex or your provincial health plan.

The Health Spending Account (HSA) is considered a private health services plan. The way the Health Spending Account works and the expenses it can be used for are governed by the Income Tax Act (Canada) and the Canada Revenue Agency.

For more information on Health Spending Account rules, consult the General Income Tax Guide published by the Canada Revenue Agency or the most current version of publication #IT519 – Medical Expense and Disability Tax Credits and Attendant Care Expense Deduction, available on the Canada Revenue Agency website.

|

HOW THE HEALTH SPENDING ACCOUNT WORKS

|

|

|

You deposit unused flex credits into your HSA

|

|

|

You submit claims to the account

|

|

|

If you use all the flex credits in your HSA in one year |

|

|

If you have flex credits left over in your HSA at the end of the benefit plan year |

|

|

If you still have unused flex credits remaining after two years, you lose them |

|

The federal government determines the expenses that are eligible for reimbursement from your Health Spending Account.

You can use your HSA to help pay for the same expenses you can claim for the Medical Expense Tax Credit. These expenses are defined in the Income Tax Act. The entire list of eligible expenses for the HSA is available on the Canada Revenue Agency website.

The types of expenses you can submit to your HSA include:

Although you can only cover your spouse and dependent children for Extended Health Care and Dental, you can submit claims to your HSA for a broad range of dependents. According to Canada Revenue Agency rules, these can include anyone you claim on your income tax return as a financial dependent, such as:

To be eligible, these dependents must:

For more information about eligible dependents, see the Medical Expense and Disability Tax Credits and Attendant Care Expense Deduction bulletin on the Canada Revenue Agency website. You can also contact the Canada Revenue Agency National Call Centre at 1-800-959-8281.

Note: You may submit HSA claims for all your dependents who meet these eligibility requirements regardless of the Extended Health Care and Dental coverage you have under Sanofi myFlex. For example, if you choose employee-only coverage under the Extended Health Care and Dental Plans, you may still submit your family’s claims to your HSA.

The Health Spending Account (HSA) pays out claims after all other applicable insurance plans have paid their portions. You should submit your claims to all other sources before you submit them to your HSA.

Visit the Submit a Claim section of the Sun Life plan member website or the my Sun Life mobile app to submit an HSA claim online.

The HSA provides a tax-efficient way for you to minimize the amount you pay toward eligible Extended Health Care and Dental expenses you would otherwise pay for yourself. Any flex credits you allocate to your HSA will not be subject to federal and provincial taxes. If you live in Quebec, contributions to your HSA are considered a provincially taxable benefit, but they are subject to taxes only after the claim(s) have been paid. The benefit of using the HSA to pay for Extended Health Care and Dental expenses is that, by doing so, you use before-tax credits from Sanofi, rather than your own after-tax income.

Canada Revenue Agency (CRA) gives you a tax break on the HSA, but it does set some rules. You can carry over your unused HSA credits to the following year and you have two years to use any flex credits allocated to your HSA or they are forfeited. You can claim the expenses only in the year they are incurred. With this in mind, take a moment to consider any existing HSA balance you might have before deciding how to allocate your leftover flex credits each enrollment period. Then decide if you should allocate more flex credits to the account. Please note that when you submit an HSA claim, your oldest flex credits are used first to pay your claim to help you avoid the CRA’s two-year “use it or lose it” rule.

Visit the Canada Revenue Agency website for more information.

Sanofi is dedicated to promoting total wellbeing for all employees. Wellness activities promote healthy body and mind for all of us and improve our quality of life at home and at work.

During each open enrollment period, you can allocate some or all of your leftover flex credits to your Wellness Spending Account. You can use your Wellness Spending Account to pay for eligible physical fitness, healthy living, personal finance, and personal development expenses.

Because there are many ways for you to improve your health and wellbeing, the Wellness Spending Account allows you to select the activities that contribute best to your personal total wellbeing journey.

You can use your Wellness Spending Account throughout the year to help pay for eligible wellbeing expenses. As long as you have sufficient credits in your account, you can submit claims to your Wellness Spending Account and be reimbursed for your eligible expenses. The amount of your claims will be deducted from the balance of your account.

Once you have used all the credits in your Wellness Spending Account, you must wait until the next benefit year (July 1) to submit new claims when more flex credits can be added to your account.

Similar to the Health Spending Account “use it or lose it” rule, you have two years to use any flex credits allocated to your Wellness Spending Account or they are forfeited, and you can only claim for expenses in the year they are incurred.

Eligible Wellness Spending Account expenses include, but are not limited to, the following:

For a full listing of covered expenses, please refer to the plan booklet that is available on www.mysunlife.ca or the my Sun Life mobile app.

You can submit expenses to the Wellness Spending Account for yourself and your eligible dependents under the Sanofi myFlex benefits program.

Visit the Submit a Document section on mysunlife.ca to submit Wellness Spending Account claim online.

Any flex credits allocated to your Wellness Spending Account are a taxable benefit to you once an expense has been paid and will be included in your taxable income.

During each open enrollment period, you can allocate some or all of your leftover flex credits to your Group Tax-Free Savings Account (Group TFSA) with Sun Life. Any leftover flex credits you deposit to the Group TFSA will grow along with the rest of your savings, with the advantage of the plan’s suite of professionally managed investment funds and lower-than-retail investment management fees.

The Group Tax-Free Savings Account (Group TFSA) with Sun Life is a flexible investment savings account that allows you to earn investment income tax-free and pay no tax when you need to use your money.

You can contribute to the Group TFSA with “after-tax” dollars (money you have already paid income taxes on) and leftover Sanofi myFlex credits. Because your contributions have already been taxed, you won’t have to pay tax when you take money out of your Group TFSA.

In addition to cash, TFSAs can also hold and grow through investments. Any investments you have in your Group TFSA also grow tax-free. This means you also pay no tax on the interest your TFSA investments earn when you withdraw funds.

You can use the contributions and savings from your Group TFSA at any time, for any purpose. For example, you can use it to fund:

The Group TFSA is a safe and smart way to grow your savings without stressing too much about taxes. Just make sure you don’t go over your yearly contribution limit.

You may contribute to the Group TFSA with Sun Life in dollar amounts through convenient, after-tax payroll deductions or by depositing leftover flex credits during Sanofi myFlex open enrollment.

You decide how much you want to contribute to the Group TFSA each pay period, up to your TFSA contribution limit as determined by the Canada Revenue Agency. You can change your contribution amount at any time during the year.

Each year, the CRA sets a limit on how much you can contribute to a TFSA. Your TFSA contribution limit is the total of these three amounts:

If you have never contributed before and turned 18 in 2009 or earlier, you may contribute a lump sum of up to $102,000.

For more information about maximum contributions, please review the Canada Revenue Agency Tax-Free Savings Account Guide for Individuals.

“Vesting” refers to when you are able to access the funds in your Group TFSA account. Your individual TFSA contributions will vest immediately.

Questions?

If you have questions about your contributions, please contact Sun Life at 1-866-896-6976 or visit mysunlife.ca

Important…

If you plan to direct leftover flex credits to the Group TFSA, you must have an open Group TFSA account with Sun Life, or you must open an account, before the credits can be deposited.

For more information about enrolling in the Group TFSA with Sun Life, please visit Retirement Savings on All Well Canada

Open enrollment for the Sanofi myFlex benefits program normally takes place every two years at the beginning of June. During open enrollment, all salaried employees have the opportunity to enroll and select or update their benefits options for the upcoming two years using the online enrollment tool.

Remember that enrolling in Sanofi myFlex is more than just selecting your coverage and purchasing optional insurance. Open enrollment is a good time to review your beneficiary designation information and make any required updates.

After each open enrollment period, your new Sanofi myFlex benefits selections will take effect on July 1. Bi-weekly payroll deductions for any benefit options you purchase without flex credits will begin on the mid-July pay date.

Open enrollment occurs every other year

You will be able to update your benefits selections, beneficiaries, and dependents’ information during each biennial open enrollment period.

Before you begin your preparation to enroll, make sure you have the following on hand:

Benefits are personal, and it’s important that you take some time to consider what benefits needs you and your family may have for the coming two years. Share the information with your spouse, if you have one, and follow these three important steps to help you make the best benefits decisions for you and your family:

1. Review your benefit plan options

Review how Sanofi myFlex works and examine the flexible plan options you have for each benefit type. Visit Your Sanofi myFlex options, coverage, and rates to lean more.

2. Determine your benefits needs for the coming two years

When thinking about your benefit needs for the next two years, there are a number of things you should consider:

Visit Which Sanofi myFlex options are right for you? to find worksheets, “People like me” scenarios, and questions to ask yourself to help you decide which Sanofi myFlex options are right for you and your family.

3. Enroll and make choices that matter!

Once you have reviewed all the Sanofi myFlex plan and decision-support information and have decided on the best coverage options to meet you and your family’s needs for the coming two years, you will need to make your selections using the online enrollment tool. The enrollment tool is available through the Sanofi Canada Benefits Centre during the open enrollment periods, which you can access by going to the home page on All Well Canada > Sanofi Canada Benefits Centre.

Once you have assessed your needs and determined which flexible benefits plan options are right for you and your family, you can enroll and make changes in Sanofi myFlex every two years using the online enrollment tool. You can access the enrollment tool through the Sanofi Canada Benefits Centre by going to the home page on All Well Canada > Sanofi Canada Benefits Centre.

When you arrive at the Benefits Centre website:

If you have questions about your coverage or claims, need help updating your benefit plan options because of a life event (e.g., change in marital status, birth of a child), or any other questions about your benefits, you only need to call one number – the Sanofi Canada Benefits Centre at 1 855 928-5617. When you reach the automated Benefits Centre, just follow the recorded prompts to access to the right team for your needs.

The Sanofi Canada Benefits Centre offers a one-stop point of contact for all your benefits needs:

If you are new to Sanofi and do not actively enroll in Sanofi myFlex or miss the enrollment deadline, without exception you will receive default coverage for each benefit plan or option. You will not be able to change your coverage until the next enrollment period or if you experience a qualifying life event. This may not be exactly what you and your family want or need.

If you enrolled during the past open enrollment period and do not actively enroll/make changes during the next open enrollment period, your selections, beneficiaries, and dependents’ information will not change. Any unused flex credits will be deposited into a Wellness Spending Account.

We encourage you to actively select your options during the open enrollment period to ensure you receive the coverage you and your family need for the coming two years.

* Sanofi provides variety of mental health support and work-life services for you and your family. For more information, please visit All Well Canada.

Sanofi myFlex provides a variety of benefits plans and options designed to help keep you and your family physically, mentally, and financially healthy. Each section below outlines the coverage levels, options, and provisions within each plan to help you decide which selections will best meet the unique needs of you and your family.

For most of us, maintaining good health is one of our highest priorities. If staying healthy was just a matter of eating well and exercising, life would be simple. But we also need support and financial security when an illness or medical need arises. The Sanofi myFlex benefits program provides a range of flexible Extended Health Care Plan options to help you stay well – both physically and mentally.

The Extended Health Care Plan is designed to help you and your eligible dependents cover most of the health-related expenses not covered by your provincial healthcare plan. This includes prescription drugs, paramedical services, medical services & supplies, vision, and mental health care. It covers reasonable and customary charges for eligible expenses, based on the option you choose.

To participate in the Sanofi myFlex Extended Health Care Plan, you and your dependents must meet the following eligibility requirements.

|

Employees |

To be eligible, you must be:

|

|

Your spouse |

Your spouse is eligible for coverage as long as they are the person:

You can only cover one spouse at a time. |

|

Your dependent child(ren) |

Your dependent child(ren) is eligible for coverage as long as they are the biological or adopted child(ren) of either you or your eligible spouse, unmarried, and:

|

When you choose your Extended Health Care Plan, you select one of the following coverage categories.

|

Employee only |

You can choose to cover only yourself. You can pick this level of coverage even if you have an eligible spouse and/or child. |

|

Employee + 1 dependent |

You can choose to cover yourself and one other dependent. The dependent can be your eligible spouse or eligible child. |

|

Employee + 2 or more dependents |

You can choose to cover yourself and two or more dependents. This could be you, your eligible spouse, and one or more dependent child(ren). It could also be just you and two or more dependent children. |

Important:

You can select different coverage categories for your Extended Health Care and Dental Plans.

Your needs for Extended Health Care coverage may vary according to your individual circumstances and family situation. You may have no other source of health coverage outside your provincial plan, or you may have coverage through your spouse’s employer or another personal extended health care plan. Everyone’s needs are different, so the Extended Health Care Plan gives you four options to choose from so you can tailor the plan to suit your unique needs:

You can change your plan during each open enrollment period or if you have an eligible life event. During open enrollment, you can also move up or down as many plan options as you wish (for example, from Plan One to Plan Three).

You may consider coordinating your benefits coverage with your spouse’s plan to maximize the reimbursement you can receive for your expenses.

If you are a fixed-term contract (FTC) employee who is eligible to join Sanofi myFlex, you will automatically be placed into Extended Health Care Plan Three at no cost to you. Don’t forget, you still need to add or update your dependents’ information during open enrollment to make sure they are covered by Sanofi myFlex.

|

Plan One |

Plan Two |

Plan Three |

Plan Four |

|

|---|---|---|---|---|

|

Flex credits released to use elsewhere |

Flex credits released to use elsewhere |

No flex credits released |

Payroll deduction required |

|

|

Annual deductible

|

$1,000 |

$0 |

$0 |

$0 |

|

Prescription Drugs |

||||

|

50% |

70% |

90% |

100% |

|

||||

|

$2,500 |

$1,200 |

$400 |

– |

|

$3,500 |

$1,800 |

$600 |

– |

|

$4,000 |

$2,100 |

$700 |

– |

|

Yes |

Yes |

Yes |

Yes |

|

Hospital |

100% semi-private |

100% semi-private |

100% semi-private |

100% private |

|

Paramedical services |

||||

|

50% |

70% |

80% |

90% |

|

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

Not covered |

$500 |

$1,000 |

$1,500 |

|

Vision |

||||

|

Not covered |

Eye exam only |

80% |

90% |

|

$250 per 24 months per person plus eye exam |

$400 per 24 months per person plus eye exam |

||

|

Out-of-country/ |

||||

|

100% |

100% |

100% |

100% |

|

$1 million |

$1 million |

$1 million |

$1 million |

|

Other health coverage |

Not covered |

70% |

80% |

90% |

Maximums shown are per covered person.

Covered expenses will not exceed reasonable and customary charges in the regional area where the service and supplies are provided.

Why do paramedical practitioners have combined maximums?

The majority of employees use one or two paramedical practitioners at most and often don’t claim the maximum amount. Individual maximums for each paramedical practitioner also limit how much you can claim for the practitioners you actually use most. Combined maximums give employees a larger maximum to use and greater control over where and how they want to use their benefits.

The 2025-2026 flex credits and premiums for your Extended Health Care Plan options are shown in the table below.

|

Extended Health Care |

|||||

|---|---|---|---|---|---|

|

Employee |

Employee + 1 |

Employee + |

+ |

Additional Wellness |

|

|

$919 |

$1,745 |

$2,388 |

+ |

$300 |

|

|

Plan 1 |

ER : $455 |

ER : $864 |

ER : $1,182 |

||

|

Plan 2 |

ER : $671 |

ER : $1,275 |

ER : $1,745 |

||

|

Plan 3 |

ER : $919 |

ER : $1,745 |

ER : $2,388 |

||

|

Plan 4 |

ER : $919 |

ER : $1,745 |

ER : $2,388 |

||

|

Plan 1 |

$464 |

$881 |

$1,206 |

+ |

$300 |

|

Plan 2 |

$248 |

$470 |

$643 |

||

|

Plan 3 |

– |

– |

– |

||

|

Plan 4 |

– |

– |

– |

||

* Annual payroll deduction amounts, if required, are spread across each of your regular bi-weekly pay periods during the year.

** The $300 Wellness flex credits can be used to help minimize payroll deductions to reduce your annual costs. There is a total of $300 Wellness flex credits available per benefit year.

To be eligible for coverage, your drugs must:

The maximum amount you can have filled at one time for one prescription is a three-month supply.

Your Sun Life Benefit Card is your pay direct drug card. This card allows you to pay only the percentage of the cost not covered under your Extended Health Care Plan when you fill your prescription.

Your digital Sun Life Benefit Card is available at mysunlife.ca and on the my Sun Life mobile app once you enroll in the Extended Health Care Plan. A plastic card will not be issued.

If you are covered under your spouse’s plan, you may be able to submit the amount not covered by Sanofi myFlex (the co-insurance) to that plan for reimbursement. See Coordinating health benefit claims with another program below.

If you are over age 65 and are required to pay a drug benefit co-pay or deductible under your provincial prescription drug program, you can submit these expenses to your Extended Health Care Plan for reimbursement.

Legislation requires Sun Life to follow the RAMQ (The Régie de l’assurance maladie du Quebec) reimbursement guidelines for all residents of Quebec.

If any provisions of this plan do not meet the minimum requirements of the RAMQ plan, adjustments are automatically made to meet RAMQ requirements.

If you live in Quebec and you choose Plan One for Extended Health Care, drug claims will be paid in accordance with RAMQ guidelines.

Depending on the Extended Health Care Plan you select, a semi-private or a private room (if available) in a hospital or the government-authorized co-payment for accommodation in a nursing home is covered when provided in Canada, and the treatment received is acute, convalescent, or palliative care.

Eligible paramedical practitioners include registered:

Eligible paramedical practitioners must be licensed by their provincial regulatory agency or a registered member of a professional association, and Sun Life must recognize that association. Contact the Sun Life Contact Centre to confirm practitioner eligibility.

Note: Podiatry services are not eligible until your provincial health insurance plan annual maximums have been exhausted.

Eligible medical health practitioners include registered:

Counselling services by a registered mental health service provider are covered for up to $2000 per benefit year per covered individual under Sanofi myFlex regardless of your choice of plan. If you select Plan One, mental health services are not subject to the annual deductible.

For more information about mental health support services provided by Sanofi, please visit All Well Canada.

You are covered for reasonable and customary charges for a range of medical supplies and services. Some items may require a pre-estimate. To confirm eligibility before you purchase or rent equipment, you or your service provider should submit the applicable pre-estimate to Sun Life. The pre-estimate information is available on mysunlife.ca.

Depending on the Extended Health Care Plan you select, eligible vision care expenses include reimbursement for the services performed by a licensed optometrist or ophthalmologist for:

Out-of-country and province emergency medical coverage provides protection to you and your family when you travel outside of Canada or your home province.

Sun Life’s travel assistance provides access to a global network of multilingual assistants who can direct you to the nearest, most appropriate physicians and healthcare facilities when you’re travelling out of country.

Your travel medical card and details of your coverage are available on mysunlife.ca or the Sun Life mobile app.

Visit the Submit a Claim section of the Sun Life plan member website or the my Sun Life mobile app to submit a claim online.

Your medical and paramedical service providers (e.g., physiotherapists) may be able to bill Sun Life directly, and payment will be made directly to the provider.

This benefits you, the program member, because you do not have to wait to receive your claims payment nor do you have to pay out-of-pocket up front (other than for your portion of the benefit).

There are more than 29,000 healthcare providers signed up for Provider eClaims across Canada. To find out if your providers are registered, check out the provider listing mysunlife.ca.

If your provider cannot bill Sun Life directly, you must pay for the full amount of the healthcare services and submit a claim online for reimbursement.

Coordinating benefit claims is a process that allows you to submit Extended Health Care claims to more than one plan. By doing so, you can maximize the reimbursement you receive (up to 100% of the claim) and limit your out-of-pocket expenses.

You can coordinate benefits for:

To coordinate benefit claims, you must enroll your spouse and/or child(ren) as dependents in Sanofi myFlex. Your spouse must also enroll you and/or your child(ren) in their benefits program.

When you submit a claim, if the first plan does not cover your full expense, you can submit the remaining amount to the second plan and be reimbursed up to 100% of the cost. Covered expenses will not exceed reasonable and customary charges and plan maximums.

If you and your spouse both have extended health care coverage, be sure to provide your coordination of benefit claims information to the pharmacy or your service provider on your first visit. Once they have this information on file, your pharmacist and/or your provider can also coordinate coverage for your prescription drugs and other Extended Health Care services.

When you coordinate benefit claims, there is an order in which you must submit your claims:

|

CLAIMS FOR YOU |

|

|---|---|

|

Submit the claim and receipts to Sanofi myFlex first |

|

|

Submit the remaining portion of the claim to your spouse’s benefits plan |

|

|

CLAIMS FOR YOUR SPOUSE |

|

|---|---|

|

Submit the claim and receipts to your spouse’s plan first |

|

|

Submit the remaining portion of the claim to Sanofi myFlex |

|

|

CLAIMS FOR YOUR CHILD(REN) |

|

|---|---|

|

Submit the claim and receipts first to the benefits program of the parent whose month and day of birth is earliest in the year |

|

|

Submit the remaining portion of the claim to the other parent’s plan |

|

If you are divorced, legally separated, or have remarried or entered into a common-law relationship with another individual, the process for submitting claims for your children will depend on your custody arrangement (see chart below).

In all cases, to coordinate benefits, you and your ex-spouse must both enroll your child(ren) as a dependent in your respective benefit plans.

|

Submit first |

Submit second |

|

|---|---|---|

|

If you have custody and have not remarried or entered into a common-law relationship |

Sanofi myFlex |

Your ex-spouse’s program |

|

If you have custody and have remarried or entered into a common-law relationship |

Sanofi myFlex |

Your new spouse’s program* |

|

If your ex-spouse has custody and they have not remarried or entered into a common-law relationship |

Your ex-spouse’s program |

Your Benefits Program |

|

If your ex-spouse has custody and they have remarried or entered into a common-law relationship |

Your ex-spouse’s program |

Your ex-spouse’s new spouse’s program** |

|

If your share custody with your ex-spouse |

The program of the parent whose birth month and day is earliest in the year |

The other parent’s program |

|

If your custody situation is unresolved |

The program of the parent who has covered the child the longest |

The other parent’s program |

*Your new spouse must enroll your child(ren) as a dependent in their benefits program. If there is still an unpaid portion of an expense remaining after it is submitted to Sanofi myFlex, the claim should then be submitted to your new spouse’s plan (provided they have enrolled your child as a dependent).

**Your ex-spouse’s new spouse must enroll your child(ren) as a dependent in their benefits program. If there is still an unpaid portion of an expense remaining after it is submitted to your ex-spouse’s program, the claim should then be submitted to your ex-spouse’s new spouse’s plan (provided they have enrolled your child as a dependent).

Benefit claims for your dependent child(ren) who are under age 26 and a full-time student at an accredited educational institution should be submitted to their school’s benefits plan first.

|

CLAIMS FOR YOUR DEPENDENT ADULT CHILD(REN) ATTENDING SCHOOL

|

|

|

Submit the claim and receipts first to the benefits program of the educational institution your child(ren) is attending

|

|

|

Submit the remaining portion of the claim to Sanofi myFlex

|

|

If any employer cost (including flex credits) is transferred to any of the following accounts, the amount transferred is a taxable benefit for you:

Any amount Sanofi contributes to the above accounts is added to your taxable income for both your federal and provincial taxes. The amount paid by Sanofi for all your other benefits is tax-free in all provinces except Quebec.

If you live in Quebec, any amount that Sanofi pays for Extended Health Care coverage is also a taxable benefit to you for provincial tax purposes.

Residents of Ontario and Quebec are required to pay Sales Tax on all insurance premiums. Residents of Manitoba are required to pay Sales Tax on all insurance premiums except for Extended Health Care and Dental coverage.

Your Sanofi myFlex coverage ends at the earlier of the date you:

Coverage for your spouse or your dependent children ends when you are no longer eligible to participate in Sanofi myFlex or when they no longer meet the eligibility requirements.

You are required to cancel the Sanofi myFlex coverage for your children and/or spouse at the point you no longer have an eligible spouse and/or eligible dependent children.

The Dental Plan is designed to help you keep your teeth and gums healthy. As with the Extended Health Care Plan, your needs for Dental coverage will vary according to your individual circumstances and family situation. You may get by with a routine check-up and cleaning once a year, or you may need more extensive dental care. You may have no other source of dental coverage, or you may have coverage through your spouse’s employer or another personal dental plan.

You may consider coordinating your benefits program coverage with your spouse’s plan to maximize the reimbursement you can receive for your expenses.

To participate in the Dental Plan, you and your dependents must meet the following eligibility requirements.

|

Employees |

To be eligible, you must be:

|

|

Your spouse |

Your spouse is eligible for coverage as long as they are the person:

|

|

Your dependent child(ren) |

Your dependent child(ren) is eligible for coverage as long as they are the biological or adopted child(ren) of either you or your eligible spouse, unmarried, and:

|

When you choose your Dental coverage, you also select one of the following coverage categories.

|

Employee only |

You can choose to cover only yourself. You can pick this level of coverage even if you have an eligible spouse and/or child. |

|

Employee + 1 dependent |

You can choose to cover yourself and one other dependent. The dependent can be your eligible spouse or eligible child. |

|

Employee + 2 or more dependents |

You can choose to cover yourself and two or more dependents. This could be you, your eligible spouse, and one or more dependent child(ren). It could also be just you and two or more dependent children. |

Important:

You can select different coverage categories for your Extended Health Care and Dental Plans.

Everyone’s dental needs are different. The Dental Plan gives you four plan options to choose from so you can tailor the plan to suit your unique needs:

The reimbursement you receive for your dental expenses depends on the Dental Plan you select.

You can change your plan during each open enrollment period or if you have an eligible life event. During open enrollment you can move up or down as many plan options as you wish (for example, from Plan Four to Plan Two).

If you are a fixed-term contract (FTC) employee who is eligible to join Sanofi myFlex, you will automatically be placed into Dental Plan Three at no cost to you. Don’t forget, you still need to add or update your dependents’ information during open enrollment to make sure they are covered by Sanofi myFlex.

|

Plan One |

Plan Two |

Plan Three |

Plan Four |

|

|---|---|---|---|---|

|

Flex credits released to use elsewhere |

Flex credits released to use elsewhere |

No flex credits released |

Payroll deduction required |

|

|

Full recall exams |

Not covered/ |

Every 9 months |

Every 9 months |

Every 9 months |

|

Basic |

70% |

90% |

100% |

|

|

Major |

Not covered |

50% |

50% |

|

|

Combined annual maximum* |

$1,000 |

$2,000 |

$2,500 |

|

|

Orthodontia (adult and child) |

Not covered |

50% |

50% |

|

|

Lifetime orthodontia maximum |

– |

$2,000 |

$3,000 |

Coverages shown are per covered person.

Plan pays based on current provincial fee guide.

Combined annual maximum does not include orthodontia maximum.

The 2025-2026 flex credits and premiums for your Dental Plan are shown in the table below.

|

Dental |

|||||

|---|---|---|---|---|---|

|

Employee |

Employee + 1 |

Employee + |

+ |

Additional Wellness |

|

|

$346 |

$657 |

$899 |

+ |

$300 |

|

|

Plan 1 |

ER : $0 |

ER : $0 |

ER : $0 |

||

|

Plan 2 |

ER : $219 |

ER : $417 |

ER : $570 |

||

|

Plan 3 |

ER : $346 |

ER : $657 |

ER : $899 |

||

|

Plan 4 |

ER : $346 |

ER : $657 |

ER : $899 |

||

|

Plan 1 |

$346 |

$657 |

$899 |

+ |

$300 |

|

Plan 2 |

$127 |

$240 |

$329 |

||

|

Plan 3 |

– |

– |

– |

||

|

Plan 4 |

– |

– |

– |

||

*Annual payroll deduction amounts, if required, are spread across each of your regular bi-weekly pay periods during the year.

**The $300 Wellness flex credits can be used to help minimize payroll deductions to reduce your annual costs. There is a total of $300 Wellness flex credits available per benefit year.

Depending on the plan option you select, a range of basic, major, and orthodontic services may be covered under the Dental Plan.

Basic dental services are designed to help you maintain healthy teeth and gums. These types of services include:

Major dental services include:

Covered orthodontic services are designed to help position teeth and bite in a normal and harmonious relationship and bite.

Orthodontia is covered for both children and adults.

The dental association of each province (except Alberta) publishes a dental fee guide every year.

Please note:

Sanofi myFlex will not pay for charges exceeding the dental fee guide, including dental specialist fees. If the dentist charges more than what is published in the dental fee guide, your Dental Plan does not cover the higher amount. It’s a good idea to bring this to your dentist’s attention and discuss the fees with your dentist before you undergo a particular procedure.

The Dental Plan will reimburse the amount shown in the dental fee guide for the least expensive service or supply, provided that both courses of treatment are a benefit under the plan.

If you aren’t sure whether the Dental Plan covers a specific procedure, or if you expect major or unusual expenses, call Sun Life before you begin treatment to find out if you are covered.

For all proposed treatment for crowns, onlays, and bridges, your dentist must complete and submit an estimate to Sun Life for assessment. Sun Life’s assessment of the proposed treatment may result in a lesser benefit being payable or may result in benefits being denied. Failure to submit an estimate prior to beginning your treatment will result in the delay of the assessment.

Except in the case of an emergency, if your dentist expects all other treatments to cost more than $300, you should have your dentist send the proposed treatment plan to Sun Life before beginning treatment.

Visit the Submit a Claim section of the Sun Life plan member website, mysunlife.ca or the my Sun Life mobile app to submit a claim online.

Your dental care service providers may be able to bill Sun Life directly, and payment will be made directly to the provider. This allows you to pay only the percentage of the cost not covered under your Dental Plan option when you visit your dentist.

If your provider cannot bill Sun Life directly, you must pay for the full amount of the services and submit a claim online for reimbursement.

You may need to provide your Sun Life Benefit Card to your dentist. Your digital Sun Life Benefit Card is available at mysunlife.ca and on the my Sun Life mobile app once you enroll in the Dental Plan. A plastic card will not be issued.

If you are covered under your spouse’s plan, you may be able to submit the amount not covered by Sanofi myFlex (the co-insurance) to that plan for reimbursement. See “Coordinating Dental benefit claims with another program” below.

Coordinating benefit claims is a process that allows you to submit Dental claims to more than one plan. By doing so, you can maximize the reimbursement you receive (up to 100% of the claim) and limit your out-of-pocket expenses.

You can coordinate benefit claims for:

To coordinate benefit claims, you must enroll your spouse and/or child(ren) as dependents in Sanofi myFlex. Your spouse must also enroll you and/or your child(ren) in their benefits program.

When you submit a claim, if the first plan does not cover your full expense, you can submit the remaining amount to the second plan and be reimbursed up to 100% of the cost. Covered expenses will not exceed reasonable and customary charges and plan maximums.

If you and your spouse both have dental coverage, be sure to provide your coordination of benefit claims information to your service provider on your first visit. Once they have this information on file, your provider may be able to coordinate coverage for your prescription drugs.

When you coordinate benefit claims, there is an order in which you must submit your claims:

|

CLAIMS FOR YOU |

|

|---|---|

|

Submit the claim and receipts to Sanofi myFlex first |

|

|

Submit the remaining portion of the claim to your spouse’s benefits plan |

|

|

CLAIMS FOR YOUR SPOUSE |

|

|---|---|

|

Submit the claim and receipts to your spouse’s plan first |

|

|

Submit the remaining portion of the claim to Sanofi myFlex |

|

|

CLAIMS FOR YOUR CHILD(REN) |

|

|---|---|

|

Submit the claim and receipts first to the benefits program of the parent whose month and day of birth is earliest in the year |

|

|

Submit the remaining portion of the claim to the other parent’s plan |

|

If you are divorced, legally separated, or have remarried or entered into a common-law relationship with another individual, the process for submitting claims for your children will depend on your custody arrangement (see chart below).

In all cases, to coordinate benefits, you and your ex-spouse must both enroll your child(ren) as a dependent in your respective benefit plans.

|

Submit first |

Submit second |

|

|---|---|---|

|

If you have custody and have not remarried or entered into a common-law relationship |

Sanofi myFlex |

Your ex-spouse’s program |

|

If you have custody and have remarried or entered into a common-law relationship |

Sanofi myFlex |

Your new spouse’s program* |

|

If your ex-spouse has custody and they have not remarried or entered into a common-law relationship |

Your ex-spouse’s program |

Your Benefits Program |

|

If your ex-spouse has custody and they have remarried or entered into a common-law relationship |

Your ex-spouse’s program |

Your ex-spouse’s new spouse’s program** |

|

If your share custody with your ex-spouse |

The program of the parent whose birth month and day is earliest in the year |

The other parent’s program |

|

If your custody situation is unresolved |

The program of the parent who has covered the child the longest |

The other parent’s program |

*Your new spouse must enroll your child(ren) as a dependent in their benefits program. If there is still an unpaid portion of an expense remaining after it is submitted to Sanofi myFlex, the claim should then be submitted to your new spouse’s plan (provided they have enrolled your child as a dependent).

**Your ex-spouse’s new spouse must enroll your child(ren) as a dependent in their benefits program. If there is still an unpaid portion of an expense remaining after it is submitted to your ex-spouse’s program, the claim should then be submitted to your ex-spouse’s new spouse’s plan (provided they have enrolled your child as a dependent).

Benefit claims for your dependent child(ren) who are under age 26 and a full-time student at an accredited educational institution should be submitted to their school’s benefits plan first.

|

CLAIMS FOR YOUR DEPENDENT ADULT CHILD(REN) ATTENDING SCHOOL |

|

|---|---|

|

Submit the claim and receipts first to the benefits program of the educational institution your child(ren) is attending |

|

|

Submit the remaining portion of the claim to Sanofi myFlex |

|

If any employer cost (including flex credits) is transferred to any of the following accounts, the amount transferred is a taxable benefit for you:

Any amount Sanofi contributes to the above accounts is added to your taxable income for both your federal and provincial taxes. The amount paid by Sanofi for all your other benefits is tax-free in all provinces except Quebec.

If you live in Quebec, any amount that Sanofi pays for Dental coverage is also a taxable benefit to you for provincial tax purposes.

Residents of Ontario and Quebec are required to pay Sales Tax on all insurance premiums. Residents of Manitoba are required to pay Sales Tax on all insurance premiums except for Extended Health Care and Dental coverage.

Your Sanofi myFlex coverage ends at the earlier of the date you:

Coverage for your spouse or your dependent children ends when you are no longer eligible to participate in Sanofi myFlex or when they no longer meet the eligibility requirements.

You are required to cancel the Sanofi myFlex coverage for your children and/or spouse at the point you no longer have an eligible spouse and/or eligible dependent children.

No one ever wants to think about something bad happening – like an accident or an illness. Unfortunately, we all know at least one person this has happened to. Sanofi myFlex ensures your financial security during a short-term medically related absence, so you don’t need to worry about it.

If you are temporarily sick or injured and unable to work, Sanofi will continue to pay a percentage of your regular earnings, based on your service, for up to 52 weeks (effective January 1, 2024). The first five business days are considered an elimination period and must be entered as sick time in e-Time. The elimination period is waived if you are hospitalized.

Short-Term Disability (STD) coverage is a core benefit that is fully paid for by Sanofi.

Short-Term Disability (STD)/salary continuation benefits are available to permanent salaried employees only.

There are some key definitions to keep in mind when reviewing your disability benefits:

Short-Term Disability (STD) benefits provide you with salary continuation while you are unable to work due to non-occupational illness or injury. If your claim is approved, the STD benefits will replace your eligible earning in accordance with the schedule below.

|

Short-Term Disability benefits* |

||

|---|---|---|

|

Employee service |

Less than 10 years |

10 years or more |

|

Elimination period** |

5 business days |

5 business days |

|

Earnings replacement

|

100% |

100% |

|

Maximum duration |

52 weeks*** |

52 weeks*** |

* Effective January 1, 2024

** Sick days may be used during the elimination period.

*** Aligns with LTD qualifying period.

Sanofi pays the full cost of Short-Term Disability.

Your eligible earnings are defined as your basic earnings from Sanofi prior to your disability.

STD applications are managed by Canada Absence. If you will be absent for more than five (5) consecutive business days, you must review Going on Disability on All Well Canada and apply for STD by contacting the Canada Absence team to request the STD application package. When all forms are completed, you and/or your physician must send them to Sun Life directly. All claims are confidentially reviewed and adjudicated by our insurance carrier, Sun Life.

STD claims are reviewed and managed by Sun Life. During your STD claim review and an approved leave, a Sun Life case manager will connect with you on a regular basis to ensure the documentation is complete and to monitor your progress and recovery. All medical documentation/information will be kept in confidence by Sun Life. You must be available to connect with your Case Manager for the duration of your absence.

Benefits including Extended Health Care, Dental, Mental Health, and Wellness benefits will continue during an approved disability. Benefit premium deductions and/or taxable benefits will be applied on a bi-weekly basis through payroll. If you transition to Long-Term Disability (LTD), benefit premium deductions will be waived for the duration of the approved leave.

For more information about other employee benefits and resources, please visit All Well Canada.

In the event you need to be off temporarily due to illness or injury, any benefit payments you receive from Sanofi during your absence from work would be subject to income tax.

Residents of Ontario and Quebec are also required to pay Sales Tax on all insurance premiums. Residents of Manitoba are required to pay Sales Tax on all insurance premiums except for Extended Health Care and Dental coverage.

Your Short-Term Disability coverage ends on the earlier of the date you:

For more information about disability, please visit Going on Disability in All Well Canada.

“It won’t happen to me.” We’d all like to think that. But the reality is we never know when a serious illness or injury will strike. We all know at least one person who has been afflicted with a serious illness or who has been seriously injured in an accident. And, all too often, these disabilities occur at a much too young age. In fact, many would argue that Long-Term Disability Insurance is even more important than Life Insurance:

Long-Term-Disability (LTD) is a separate insurance that provides a critical safety net while you’re unable to work. While many of us understand the importance of life insurance, the truth is that insurance against an accident or disease that prevents you from working is arguably even more important. A typical 30-year-old has a four times greater chance of becoming disabled than he does of dying before age 65. A full one in six Canadians will be disabled for three months or more before the age of 50.

– MoneySense magazine, May 2019 –

Long-Term-Disability (LTD) is a separate insurance that provides a critical financial safety net while you’re unable to work. Not everyone has savings or a “rainy day fund” to support them through the months – or years – it may take them to recover. LTD Insurance replaces a percentage of your income to ensure you have financial protection when you really need it.

To ensure everyone has at least a base level of protection, LTD coverage is a core benefit and Option One and Two are fully paid for by Sanofi. If you choose to select the higher protection offered by Option Three, you will pay a portion of the cost through regular bi-weekly payroll deductions. It’s important to note that because Sanofi pays all or a portion of the cost for this coverage (depending on the option you choose), any benefit payments received are taxable.

Long-Term Disability (LTD) coverage is available to permanent salaried employees only.

If you have a disability that continues beyond the 52 weeks covered by STD benefits, Long-Term Disability (LTD) benefits provide financial security until you return to work or reach age 65. LTD claims are adjudicated, managed, and paid by Sun Life. When your LTD claim is approved, benefits are paid on a monthly basis.

Sanofi myFlex offers three flexible options for Long-Term Disability coverage:

|

Option One |

Option Two |

Option Three |

|

|---|---|---|---|

|

Waiting period* |

52 weeks |

52 weeks |

52 weeks |

|

Earnings replacement |

65% |

70% |

75% |

|

Maximum monthly benefit |

$20,000 |

$20,000 |

$20,000 |

|

Flex credits released to use elsewhere |

No flex credits released |

Payroll deduction required |

* Aligns with STD maximum duration, effective January 1, 2024.

LTD coverage is an important benefit to ensure you have financial protection in case of unexpected events, and you are unable to work. This means every employee must select either Option One, Option Two, or Option Three. Opt-out from LTD coverage is not available.

LTD coverage is a core benefit and Options One and Two are fully paid for by Sanofi. If you choose to select the higher protection offered by Option Three, you will pay a portion of the cost through payroll deductions.

However, if you do not require a high level of coverage, you can select Option One, which provides lower coverage. If you select this option, additional flex credits will be “released” for you to use to fund one or more of the following:

|

LTD options |

Earnings replacement |

Flex credits released |

|---|---|---|

|

Option One |

65% |

100% paid by Sanofi |

|

Option Two |

70% |

100% paid by Sanofi |

|

Option Three |

75% |

Cost shared by Sanofi and employee |

*Annual payroll deduction amounts, if required, are spread across each of your 26 pay periods during the year.

Example:

If you earn $80,400 (gross) per year, your monthly LTD benefit would be:

Your eligible earnings for Long-Term Disability (LTD) benefits are defined as your basic earnings from Sanofi prior to your disability.

You are considered disabled if you are unable to perform the essential duties of your own occupation during the 24-months following a Short-Term Disability leave.

To qualify for Long-Term Disability (LTD) benefits beyond the 24-month period, you must be totally disabled and unable to perform the duties of any occupation for which you are reasonably qualified by training, education, or experience.

All claims are confidentially reviewed and adjudicated by our insurance carrier, Sun Life. Sun Life will automatically review claims for Long-Term Disability (LTD) once they anticipate that a Short-Term Disability claim will extend into LTD.

LTD claims are reviewed and managed by Sun Life. During an approved LTD, a Sun Life case manager will connect with you on a regular basis to ensure the documentation is complete and to monitor your progress and recovery. All medical documentation/information will be kept in confidence by Sun Life. You must be available to connect with your Case Manager for the duration of your absence.

Benefits including Extended Health Care, Dental, Mental Health, and Wellness benefits will continue during an approved disability. Taxable benefits will be applied on a bi-weekly basis, and benefit premium deductions will be waived for the duration of the approved leave.

For more information about other benefits and resources, please visit All Well Canada.

You will continue to receive LTD benefits until you reach age 65 if you are:

and

Gainful employment is defined as suitable work that you are capable of performing and that would provide you with an income of at least 60% of your pre-disability salary.

Your Long-Term Disability benefits are payable until the earlier of your:

Life Insurance is designed to give you peace of mind to know your loved ones have financial stability. If the insured person passes away, a lump sum, tax-free benefit is paid to the beneficiary. Sanofi believes it’s important to provide you with a basic level of automatic Life Insurance coverage – at no cost to you – as part of Sanofi myFlex.

At the same time, Sanofi commits to making Sanofi myFlex as flexible as possible so that you can tailor it to meet your coverage needs. For this reason, you can also select additional Optional Life Insurance for yourself, your spouse, and your dependent child(ren). The cost of any additional Optional Life Insurance you select for you, your spouse, or your child(ren) is paid through regular bi-weekly payroll deductions.

To participate in the Basic Life Insurance Plan, you and your dependents must meet the eligibility requirements in the table below. Optional Life Insurance is available to permanent salaried employees only.

|

Employees |

To be eligible, you must be:

|

|

Your spouse |

Your spouse is eligible for coverage as long as they are the person:

|

|

Your dependent child(ren) |

Your dependent child(ren) is eligible for coverage as long as they are the biological or adopted child(ren) of either you or your eligible spouse, unmarried, and:

|

Sanofi myFlex provides you with flexible employee Basic Life Insurance options. You can select coverage equal to two times your annual earnings in Option One, up to $800,000 rounded up to the next highest $1,000. However, if you do not require the highest level of coverage (i.e., you have sufficient coverage through a private life insurance plan), you have the choice to select either Option Two or Option Three, which provide lower levels of coverage. If you select either of these options, additional flex credits will be “released” for you to use to fund one or more of the following:

|

Option One |

Option Two |

Option Three |

|---|---|---|

|

|

|

|

No flex credits released |

Flex credits released to use elsewhere |

Flex credits released to use elsewhere |

|

No evidence of insurability required |

||

Important

The option you select for Basic Life Insurance will be the same option you receive for Basic Accidental Death & Dismemberment Insurance (AD&D).

Sanofi myFlex also provides you with Basic Life Insurance for your spouse and dependent child(ren).

|

Basic life insurance for: |

Coverage |

|---|---|

|

Spouse |

|

|

Dependent child(ren)* |

|

|

No evidence of insurability required |

|

* Benefit applies to all eligible children

Important note for fixed-term contract (FTC) employees

If you are a fixed-term contract (FTC) employee who is eligible to join Sanofi myFlex, you will automatically be placed into Basic Life Insurance Option One at no cost to you. Don’t forget, you still need to designate or confirm your Life Insurance beneficiary(ies) during open enrollment to make sure they are up to date.

Basic Life Insurance is a core benefit and all options are fully paid for by Sanofi. If you wish, you can select the higher protection offered by Option One. However, if you do not require a high level of coverage, you can select Option Two or Option Three, which provide lower coverage. If you select one of these lower options, additional flex credits will be “released” for you to use to fund one or more of the following:

|

Basic Life Insurance options |

Coverage |

Flex credits released |

|---|---|---|

|

Option One |

|

100% paid by Sanofi

|

|

Option Two |

|

100% paid by Sanofi |

|

Option Three |

|

Cost shared by Sanofi and employee |

*The option you select for Basic Life Insurance will be the same option you receive for Basic Accidental Death & Dismemberment Insurance (AD&D). The credit release percentages noted above apply to your combined Basic Life /Basic AD&D selection.

If you have additional life insurance needs, you may choose to buy additional Optional Life Insurance for:

Your coverage options for Optional Life Insurance are:

|

Optional Life insurance for: |

Coverage available |

Maximum coverage |

|---|---|---|

|

Employee |

|

$1,500,000 |

|

Spouse |

|

$500,000 |

|

Dependent child(ren)* |

|

$30,000 |

* Benefit applies to all eligible children

The cost of Optional Life Insurance for you and/or your spouse is based on age, gender, and smoker status. To be considered a non-smoker, you must not have smoked or vaped tobacco and/or nicotine products for 12 consecutive months. The cost of Optional Life Insurance for your child(ren) is based on a flat rate.

You pay for the cost of Optional Life Insurance through payroll deductions.

|

Age as of |

Monthly rate per $1,000 of coverage |

Monthly rate per $1,000 of coverage |

||

|

Male |

Female |

Male |

Female |

|

|

Under 25 |

$0.043 |

$0.017 |

$0.085 |

$0.032 |

|

25-29 |

$0.036 |

$0.019 |

$0.071 |

$0.039 |

|

30-34 |

$0.035 |

$0.023 |

$0.069 |

$0.046 |

|

35-39 |

$0.046 |

$0.035 |

$0.092 |

$0.069 |

|

40-44 |

$0.070 |

$0.057 |

$0.139 |

$0.114 |

|

45-49 |

$0.125 |

$0.085 |

$0.249 |

$0.169 |

|

50-54 |

$0.225 |

$0.149 |

$0.446 |

$0.295 |

|

55-59 |

$0.372 |

$0.243 |

$0.738 |

$0.482 |

|

60-64 |

$0.518 |

$0.307 |

$1.027 |

$0.610 |

|

65-69 |

$0.847 |

$0.540 |

$1.681 |

$1.073 |

Example:

If you want $50,000 of coverage (or 50 units) and you are

a 42-year-old male smoker…

$0.139 x 50 units = $6.95 per month

|

Monthly rate per $1,000 of coverage |

|

|---|---|

|

Child(ren) |

$0.228 |

Example:

If you want $15,000 of coverage (or 15 units) for your child(ren)…

$0.228 x 15 units = $3.42 per month

To be considered a non-smoker, you (and/or your spouse) must not have smoked or vaped tobacco and/or nicotine products for at least 12 consecutive months.

If you and/or your spouse start to smoke or vape, you must declare your smoking status. You must tell the Benefit Centre immediately by completing the applicable declaration form. If you don’t, you and/or your spouse’s Optional Life Insurance coverage may become invalid.

If you and/or your spouse stop smoking or vaping for at least 12 consecutive months, you may change your smoking status to non-smoker.

You may change your (and/or your spouse’s) smoking status at any time by contacting the Benefit Centre.

If you wish to purchase or add additional Optional Life Insurance for yourself and/or your spouse, you will each be required to submit an Evidence of Insurability (EOI) Form to Sun Life for approval. Coverage will only begin once Sun Life has approved your application.

Evidence of insurability is never required for Life Insurance coverage for dependent child(ren).

Your designated beneficiary is one or more individuals or organizations who you wish to receive your Sanofi myFlex Life Insurance benefits in the event of your passing.

You can designate any person and/or organization as your beneficiary. You can also designate more than one beneficiary. If you name only one primary beneficiary for your benefit, you might want to consider naming a contingent beneficiary as well. A contingent beneficiary is the person to whom you assign your Life Insurance benefits in the event your primary beneficiary passes.

If a beneficiary is under your provincial age of majority (usually 18 or 19), you should also designate a trustee for that beneficiary.

When you designate a beneficiary, the benefit is paid on a non-taxable basis. If you do not name a beneficiary or trustee, any benefits payable will go to your estate and will be subject to income tax.

You are automatically the beneficiary of any spousal and/or dependent Life Insurance you purchase.

You can designate or change your beneficiary at any time through the Benefit Centre online portal.

If you live in Quebec

If you designate your spouse as your beneficiary, the designation is “irrevocable” unless you declare otherwise. An irrevocable designation means you cannot change your beneficiary unless your spouse agrees in writing. If you declare the designation is “revocable” when you first make it, you can change it without your spouse’s consent.

Outside Quebec, all designations are revocable unless you specify otherwise.

To make a Life Insurance claim, you (or your beneficiary) should contact the Benefit Centre for instructions.

Any benefit payments received from the Basic Life Insurance Plan are not subject to income tax. The cost of Basic Life Insurance coverage, paid for by Sanofi, is a taxable benefit for you.

Any amount Sanofi contributes to your Basic Life Insurance coverage is added to your taxable income for both your federal and provincial taxes. The amount paid by Sanofi for all your other benefits is tax-free in all provinces except Quebec.

Residents of Ontario and Quebec are required to pay Sales Tax on all insurance premiums. Residents of Manitoba are required to pay Sales Tax on all insurance premiums except for Extended Health Care and Dental coverage.

Your Life Insurance coverage ends at the earlier of the date you:

Coverage for your spouse or dependent child(ren)

Life Insurance coverage for your spouse or your dependent child(ren) ends when you are no longer eligible to participate in Sanofi myFlex or when they no longer meet the eligibility requirement.

If Life Insurance coverage for you and/or your spouse ends or reduces, you may apply to Sun Life to convert your group Life Insurance coverage to an individual Life Insurance policy without providing evidence of insurability.

You must make your request to convert your coverage within 31 days of the reduction or end of the Life Insurance coverage. If you die during this 31-day period, the amount of Life Insurance available for conversion will be paid to your beneficiary or estate, even if you did not apply for conversion.

There are a number of rules and conditions in the Sanofi myFlex Life Insurance Plan that apply to converting this coverage. In all cases, the amount of the individual Life Insurance policy cannot exceed $200,000.

Note: If your Life Insurance coverage ends because you stop paying the required premiums or you reach the earlier of your retirement date or age 70, you will not be eligible to convert your coverage.

For more information on the conversion privilege, please contact Sun Life.

Accidental Death & Dismemberment (or AD&D) Insurance pays a benefit if you are hurt or pass away due to an accident. This benefit is paid in addition to any Life Insurance coverage you may have.

Basic employee AD&D Insurance is a core benefit under Sanofi myFlex and is fully paid for by Sanofi. You are also able to purchase additional Optional AD&D Insurance for yourself, your spouse, and your dependent child(ren). The cost of any additional Optional AD&D Insurance you select is paid for through regular bi-weekly payroll deductions.

To participate in the Basic AD&D Insurance Plan, you must meet the eligibility requirements in the table below. Optional employee and dependent AD&D Insurance is available to permanent salaried employees only.

|

Employees |

To be eligible, you must be:

|

|

Your spouse |

Your spouse is eligible for coverage as long as they are the person:

You can only cover one spouse at a time. |

|

Your dependent child(ren) |

Your dependent child(ren) are eligible for coverage as long as they are the biological or adopted child(ren) of either you or your eligible spouse, unmarried, and:

|

Sanofi myFlex provides you with flexible Basic AD&D Insurance options. You can select coverage equal to two times your annual earnings in Option One, up to $800,000 rounded up to the next highest $1,000. However, if you do not require the highest level of coverage, you have the choice to select either Option Two or Option Three, which provide lower levels of coverage. If you select either of these options, additional flex credits will be “released” for you to use to fund one or more of the following:

|

Option One |

Option Two |

Option Three |

|---|---|---|

|

|

|

|

No flex credits released |

Flex credits released to use elsewhere |

Flex credits released to use elsewhere |

|

No evidence of insurability required |

||

Important

The option you select for Basic Life Insurance will be the same option you receive for Basic Accidental Death & Dismemberment Insurance (AD&D).

Important note for fixed-term contract (FTC) employees

If you are a fixed-term contract (FTC) employee who is eligible to join Sanofi myFlex, you will automatically be placed into Basic AD&D Insurance Option One at no cost to you. Don’t forget, you still need to designate or confirm your AD&D beneficiary(ies) during open enrollment to make sure they are up to date.

Basic AD&D Insurance is a core benefit and all options are fully paid for by Sanofi. If you wish, you can select the higher protection offered by Option One. However, if you do not require a high level of coverage, you can select Option Two or Option Three, which provide lower coverage. If you select one of these lower options, additional flex credits will be “released” for you to use to fund one or more of the following:

|

Basic AD&D Insurance options |

Coverage |

Flex credits released |

|---|---|---|

|

Option One |

|

100% paid by Sanofi

|

|

Option Two |

|

100% paid by Sanofi |

|

Option Three |

|

Cost shared by Sanofi and employee |

*The option you select for Basic AD&D Insurance will be the same option you receive for Basic Life Insurance. The credit release percentages noted above apply to your combined Basic Life /Basic AD&D selection.

If you choose, you can purchase additional Optional Accidental Death & Dismemberment (AD&D) Insurance for:

Your coverage options for Optional AD&D Insurance are:

|

Optional AD&D insurance for: |

Coverage available |

Maximum coverage |

|---|---|---|

|

Employee |

|

$1,500,000 |

|

Spouse |

|

$500,000 |

|

Dependent child(ren)* |

|

$30,000 |

* Benefit applies to all eligible children

The cost of any Optional Accidental Death & Dismemberment (AD&D) Insurance you purchase for yourself, your spouse, or your dependent child(ren) depends on the amount of coverage you select and can be paid through regular payroll deductions.

|

Monthly rate per $1,000 of coverage |

|

|---|---|

|

Employee |

$0.03 |

|

Spouse |

$0.03 |

|

Child(ren) |

$0.09 |

Example:

If you want $100,000 of Optional AD&D coverage (or 100 units) for yourself

and $25,000 of Optional AD&D coverage (or 25 units) for your child(ren)…

If you are injured during an accident and the injury is covered, you will receive any Basic and/or Optional Accidental Death & Dismemberment (AD&D) Insurance benefits payable under Sanofi myFlex.

If you pass away, your designated beneficiary will receive any Basic and/or Optional AD&D Insurance benefits payable under Sanofi myFlex. You may designate any person and/or organization as your beneficiary. You may also designate more than one beneficiary.

If you do not designate a beneficiary, any benefits payable will go to your estate and will subject to income tax.

You can designate or change your beneficiary at any time through the Benefit Centre online portal.

You are automatically the beneficiary of any AD&D Insurance you purchase for your spouse and/or dependent child(ren).

If you designate your spouse as your beneficiary, the designation is “irrevocable” unless you declare otherwise. An irrevocable designation means you cannot change your beneficiary unless your spouse agrees in writing. If you declare the designation is “revocable” when you first make it, you can change it without your spouse’s consent.

Outside Quebec, all designations are revocable unless you specify otherwise.

To make an Accidental Death & Dismemberment (AD&D) Insurance claim, you (or your beneficiary) should contact the Benefit Centre for instructions.

Any benefit payments received from the Basic AD&D are not subject to income tax. Any amount Sanofi contributes to your Basic AD&D coverage is considered a taxable benefit and is added to your taxable income for both your federal and provincial taxes. The amount paid by Sanofi for all your other benefits is tax-free in all provinces except Quebec.

Residents of Ontario and Quebec are required to pay Sales Tax on all insurance premiums. Residents of Manitoba are required to pay Sales Tax on all insurance premiums except for Health and Dental coverage.

Your Accidental Death & Dismemberment (AD&D) Insurance coverage ends at the earlier of the date you:

Coverage for your spouse or your dependent child(ren) ends when you are no longer eligible to participate in Sanofi myFlex or when they no longer meet the eligibility requirements.